crop insurance maharashtra list Farmers are becoming disillusioned with the Prime Minister Crop Insurance Scheme. If we look at the figures of three years, there has been a decrease of more than 10 thousand insurance holders. Farmers say that the insurance company simply deposits the premium. The crop starts showing reluctance at the time of giving compensation.

There are about five lakh 10 thousand farmers in the district. In Kharif year 2020, 39113 farmers had taken crop insurance. Since then, the number of farmers holding crop insurance is decreasing year after year. This year, despite increasing the dues several times, only 29935 farmers have got crop insurance done. Dhuswa farmer Gaurav Dubey said that his crop was damaged due to rain and drought during the last three years. Compensation was not received even after claiming. Some farmers say that officials deprive them of crop compensation by confusing them with rules, due to which farmers have stopped getting crop insurance.

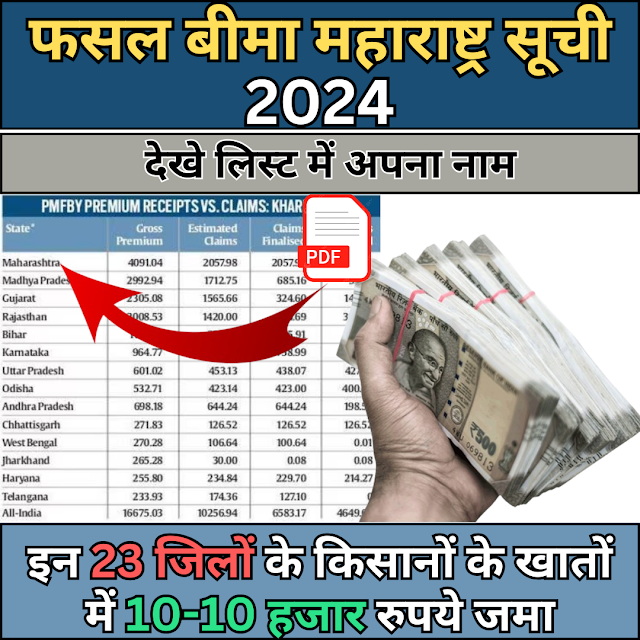

Department wise funds in Maharashtra will be distributed as follows:-

- Pune Division Rs 5 crore 37 lakh 70 thousand.

- Nashik Division: Rs 63 crore 9 lakh 77 thousand.

- Chhatrapati Sambhajinagar Division: Rs 84 crore 75 lakh 19 thousand. crop insurance

- Amravati Division: Rs 24 crore 57 lakh 95 thousand.

- Total: Rs. 177 crore, 80 lakh, 61 thousand. Each of the 23 districts of the state has received this amount as compensation.

How to check crop insurance scheme list

Crop Insurance New List- Visit the official website of the agriculture department of your state or territory.

- The list of crop insurance scheme and other information can be available there.

- Some states and territories have online registration portals for crop insurance schemes.

- You can register yourself by visiting these portals and see your name in the list.

Benefits of Prime Minister Crop Insurance

- Crop insurance provides financial assistance and covers crop damage.

- Farmers can have peace of mind as they do not need to take loans from lenders at high interest rates.

- It also reduces the risk of adopting modern and innovative farming practices, which are beneficial to their income.

- Crop insurance also strengthened the country's economy.

- Because farmers can easily repay the loan along with reimbursement from crop insurance.

Post a Comment